Go from ideas to paper and live trading in seconds

Start with ready made strategies, use as is, modify or create your own

Leverage hundreds of indicators and data points at your fingertips

Backtest with 15 years of bias free data, executing in a snap

Trade privately or sell strategies on the Marketplace

All-in-one algo-trading toolkit

Breaking Equity Algo Lab is a low-code IDE designed for automated trading and investing, allowing Algo Traders to focus on trading logic, while leaving the rest to us.

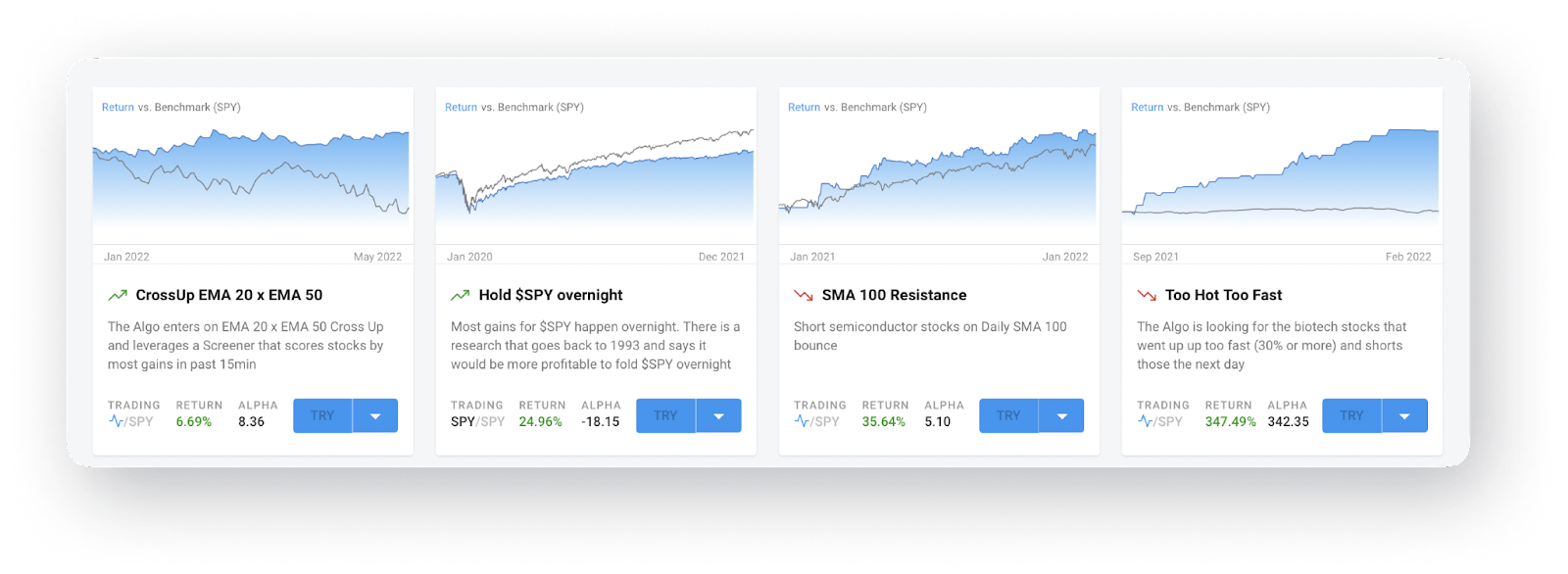

Choose from a collection of ready-made example

Explore the library of examples, use as is, modify them or create your own. Access performance, backtest parameters, and every trade details.

Use a low-code editor to build strategies

Develop your own trading strategy using our simple, online editor. Combine technical indicators with news and PR to find the alpha.

- Fully customizable

- Flexible risk controls

- Technical indicators & news

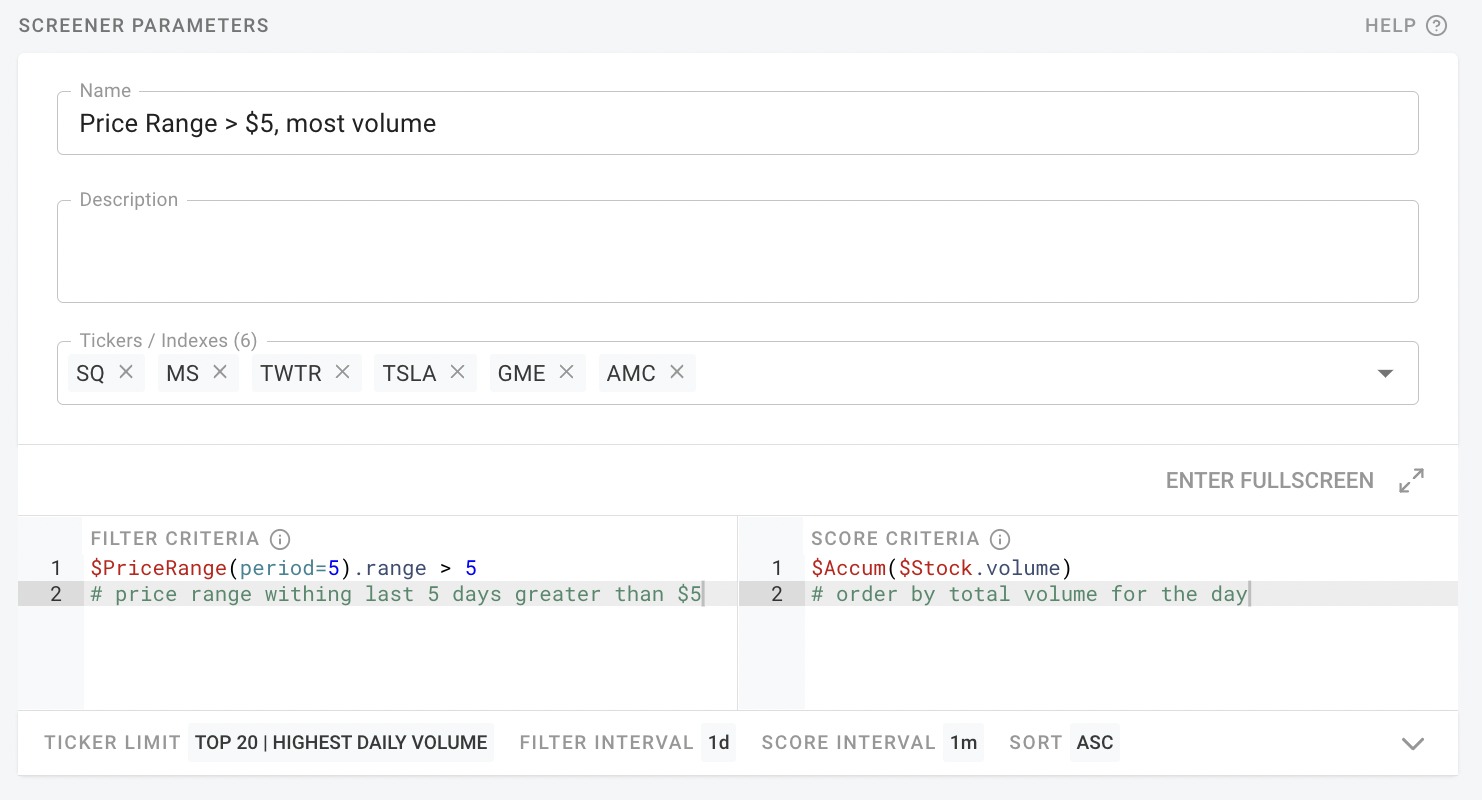

Find and screen, all US stocks

Quickly identify and focus on what you want to trade. Screen for momentum in the market, relative strength or weakness, relative volume or overbought and oversold stocks. Choose the trading details that will drive your profits.

- 15+ years of historical data

- Multiple filters at once

- Numerous technical & fundamental conditions

Mix in alternative data

Leverage alternative data points to track stocks. Use curated watchlists to follow trades that are important to you, from senate trades to CNBC stock picks and Reddit sentiment. Blend everything into robust Algos.

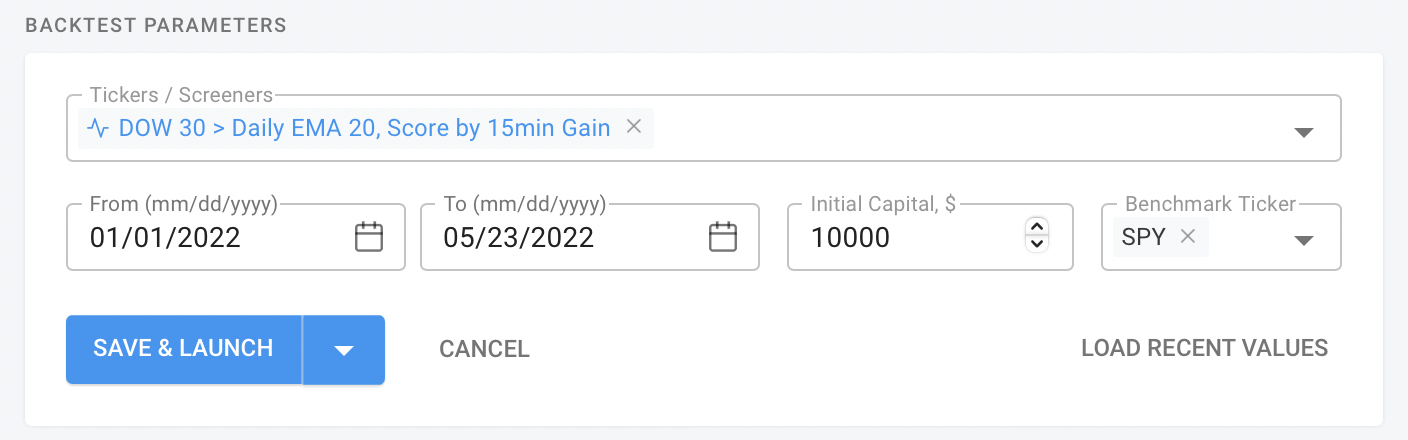

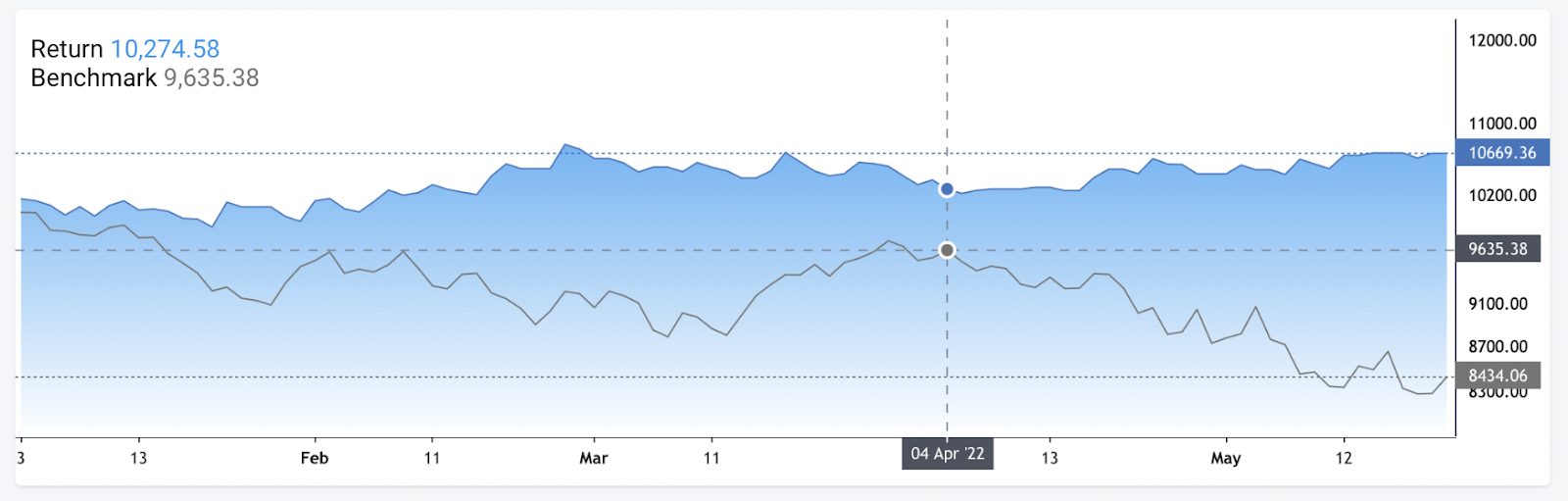

Backtest every aspect of your strategies

Validate and test your ideas against 15+ years of institutional grade historical data. Compare to a benchmark and get all the metrics in a metter a seconds. Verify it works before launching live.

- 15 years of historical intraday data

- Multiple tests within seconds

- Splippage emulation with intraday execution

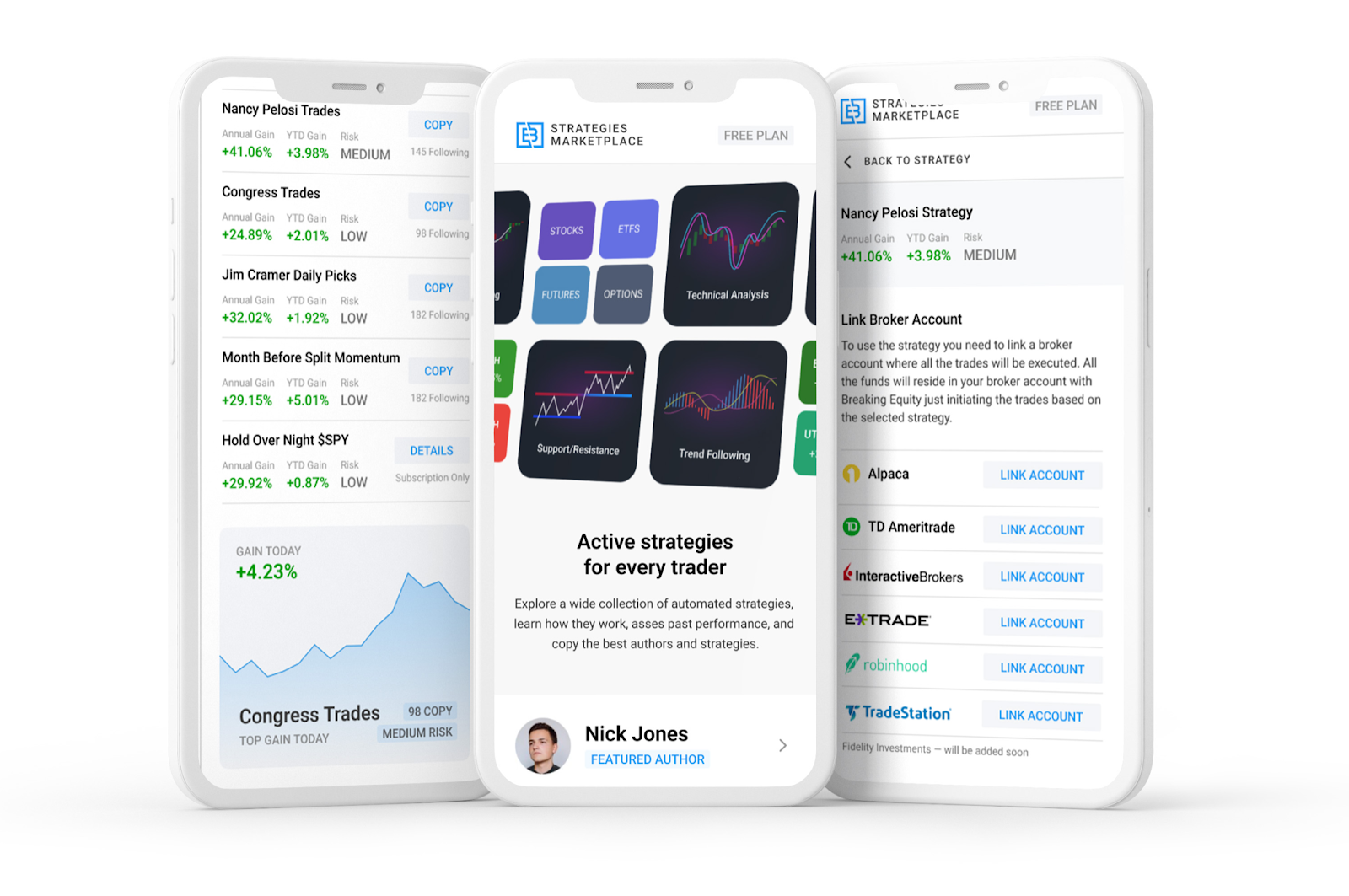

Trade privately or sell in the Marketplace

When ready, link the strategy to your existing broker account and start trading. You get a direct API integration with your broker so you can seamlessly execute trades on the broker side.

Strategy development is one thing, but why keep those cards to the chest if you have something other people are gonna want? Sell strategies on the Marketplace and get a new revenue stream. Sell your skills along with your strategies.