Explore Details

In markets, all times of day are not created equal. The open often establishes the trend and sentiment for the day. 3x leverage adds more volatility to the play which can drive better results if tamed properly.

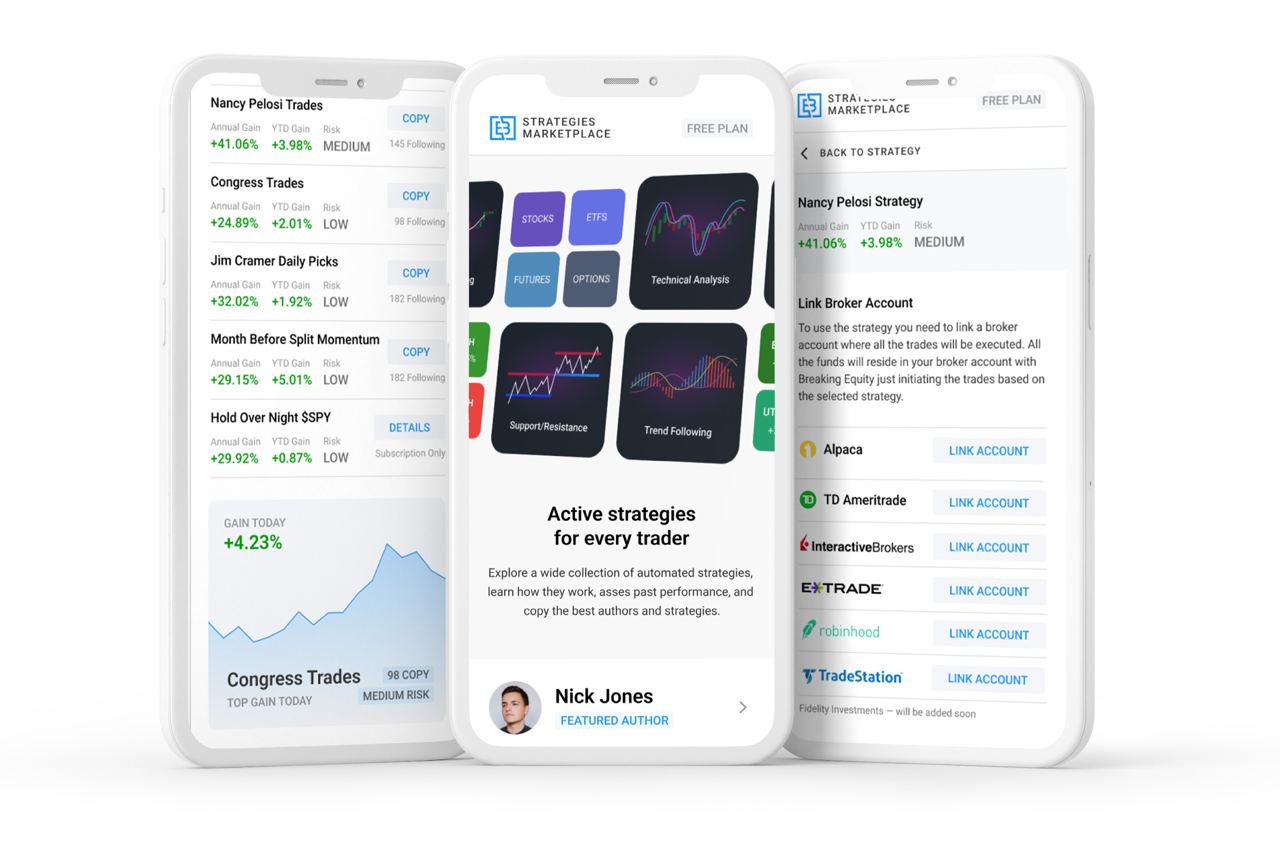

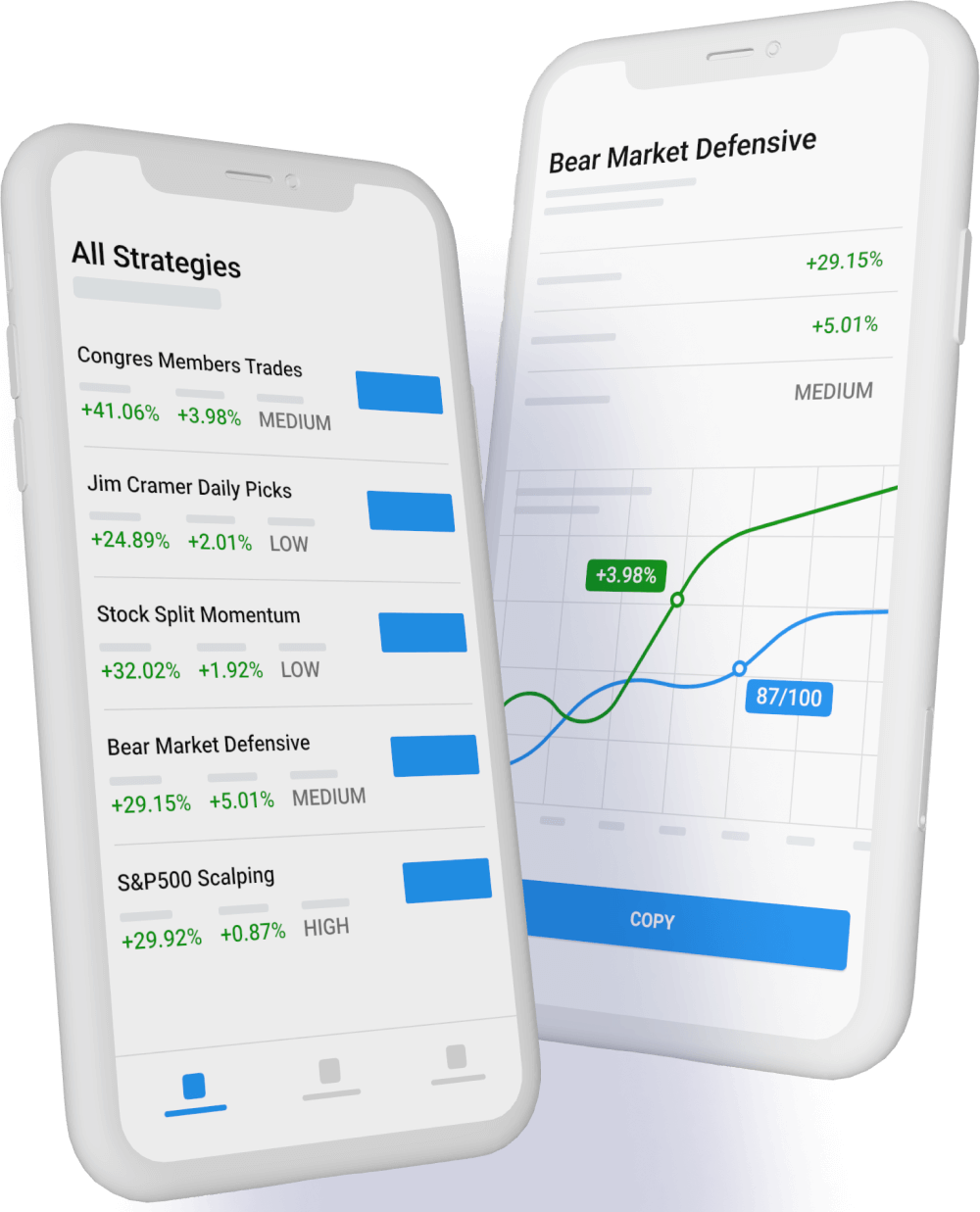

Explore the Strategies and ETFs from the best Algo Traders

Examine every aspect of the past performance

Launch one or multiple just in one click

Run right in your existing broker account

In markets, all times of day are not created equal. The open often establishes the trend and sentiment for the day. 3x leverage adds more volatility to the play which can drive better results if tamed properly.

In a Bear Market when the stocks go down the inverse ETFs such as “Direxion Daily S&P 500 Bear 3X Shares ETF” $SPXS offer great volatility, opportunities for day trading. The Strategy acts on $SPXS breakout.

Both $GME and $AMC still get a lot of attention. For example r/GME sub-reddit community has 361k members and active participation. Both companies do not shy away from actively engage into market frenzy. In such environment the Strategy attempts to make money from rapid price moves.

NIO stock is undervalued remarkably when evaluated against its American competitors, has massive potential and will attempt to get higher. This thesis is used to define an intraday strategy that captures NIO breakouts.

Hedge fund-like strategies aren’t the territory of the 1%. Whether you’re a beginner learning the basics or you simply don’t have time to watch the market while holding a 9 to 5 job, we’ve got you covered.

Explore, find, and action Strategies and ETF constructed by experts. From senate trades to Reddit sentiment, you can choose any idea you like.

When you execute a Strategy, you can see what exactly it does. How the author’s portfolio is distributed, how it’s performing.

You can track exactly who is fueling the Strategies, and the aggregate dollar amount of people following these strategies.

All the Strategies, from the simplest to the most complex, are one click away from being added to your portfolio. No hidden costs or management fees, all the traders execute directly in your broker account.

We are just a few months away from the public launch so there's still time to get on the waitlist and be a part of an active investing community from the beginning.

There are zero commitments to joining the waitlist. After you sign up for the waitlist, sit tight and we will email you with a free strategy - Jim Cramer: Hold One Day. On top of this, you will join 10,000+ investors willing to move the industry forward.

Want to get access sooner? Share your unique invite link with friends to skip ahead in line.

Breaking Equity uses a bank-grate encryption, so security is an absolute tennant. In many cases we work directly with brokers to gain access to their connectivity through the API. All funds and trade executions remain solely in your broker account. The platform only triggers your trades, and that’s it. We don’t take, hold, transfer or withdraw your money.

The Marketplace has the same concept as an App Store with free and paid strategies developed within the platform. The strategy creator sets the final price, while Breaking Equity takes a small commission.