In these blog posts we explore details of Breaking Equity Marketplace Strategies, their thesis and results. Every strategy described is available on the Marketplace and can be executed via Broker integrations.

The Thesis

It’s fairly easy to recognize a Bear Market, right? In such environments the stocks go down, the volatility goes up and the market presents day trading opportunities. One of -3x $SPY ETFs is “Direxion Daily S&P 500 Bear 3X Shares ETF” $SPXS is a great candidate for making Bear Market play on your side if you can capture price breakouts.

The Strategy

The Strategy captures $SPXS breakouts based on EMA 13×50 Cross, uses a 2% trailing stop loss and maximum 3% daily risk.

Note that the Strategy always exits before market closes at 3:57pm and never holds overnight to avoid crazy moves that can not be controlled.

The Results

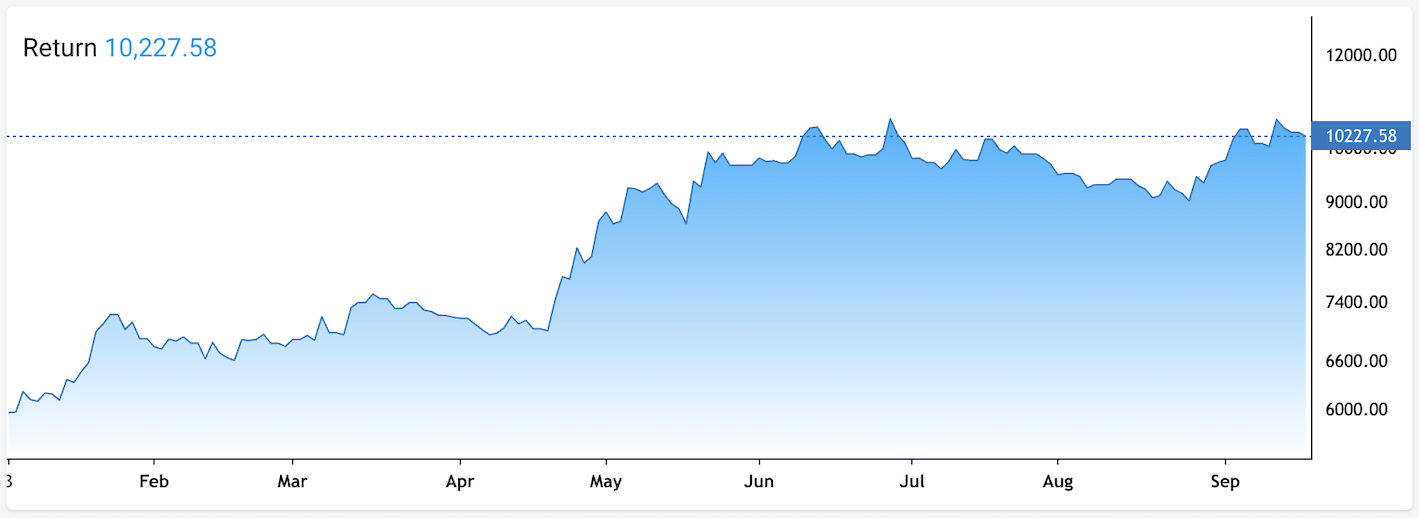

2022 is a unique opportunity to make money. Some call it once in generation Bear Market, hence we only review the results of the strategy for 2022 YTD. $6,000 at the beginning of 2022 resulted in ~$10,030 portfolio value on Sep 19, 2022 with ~14.85% maximum draw down.