In these blog posts we explore details of Breaking Equity Marketplace Strategies, their thesis and results. Every strategy described is available on the Marketplace and can be executed via Broker integrations.

The Thesis

NIO stock is undervalued remarkably when evaluated against its American competitors and has massive potential.

NIO’s stock has been going in reverse since late 2021 with stock price down by ~70% from the all-time high. Delisting concerns create a downward pressure on stock. NIO won’t be a $20 stock for long, and shares want to get considerably higher.

The Strategy

While you can not time the market you can benefit from the overall mood and momentum when day trading. The idea is simple: on the days when both $QQQ and $TSLA are going up $NIO delisting concerns are put aside and the buyers are going to pile into $NIO. More over if that happens with a lag, i.e. $QQQ and $TSLA move first and $NIO follows, both those stocks can be used as leading indicators for entry and exit.

From Technical Analysis point of view the conditions can be described via EMA Cross Over. In the Strategy we leverage 13×50 EMAs with a stop loss and max risk per day.

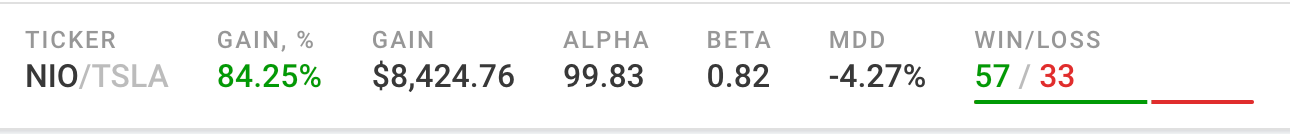

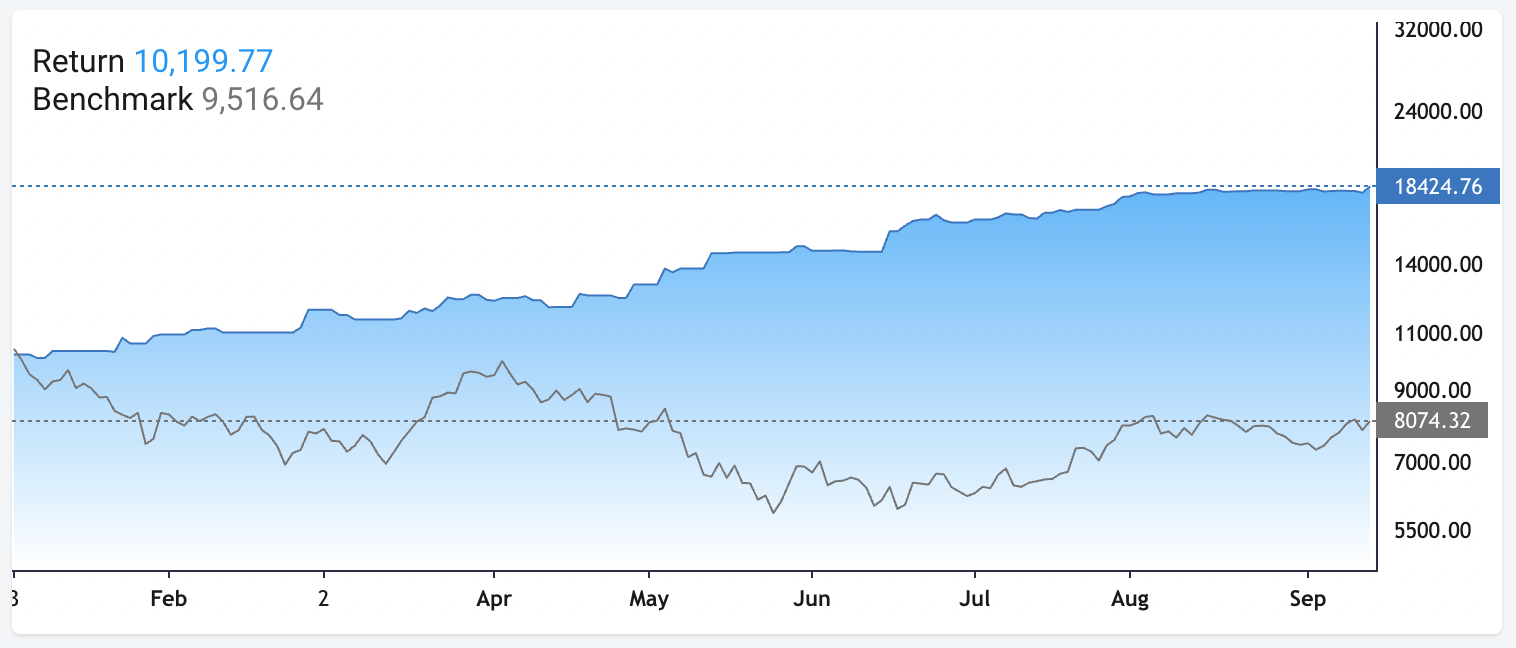

The Results

The strategy is short lived and when $NIO gets to a point of fair value, compared to American competitors, it would likely not work any more. In such setup we only review the results of the strategy for 2022 YTD.

The strategy has been developed, tested and executed live with Breaking Equity Algo Lab. The post is not a financial/investment advice and presented to the audience for educational purposes.