In these blog posts we explore details of Breaking Equity Marketplace Strategies, their thesis and results. Every strategy described is available on the Marketplace and can be executed via Broker integrations.

The Thesis

In markets, all times of day are not created equal. Usually the open and close are important. The open often establishes the trend and sentiment for the day, but there is also statistical significance to the open – intraday high or low tends to happen at the open or close more often. 3x leverage adds more volatility to the play which can drive better results if tamed.

The Strategy

The Strategy trades Biotech -3x Leverage ETFs $LABD and $LABU which are 300% of the performance of the S&P Biotechnology Select Industry Index. Long position is opened on upward movement above opening high.

The Strategy uses 2% Trailing Stop Loss and has max risk per day 3% with a maximum of 5 daily trades.

Note that the Strategy always exits before market closes at 3:57pm and never holds overnight to avoid crazy moves that can not be controlled.

The Results

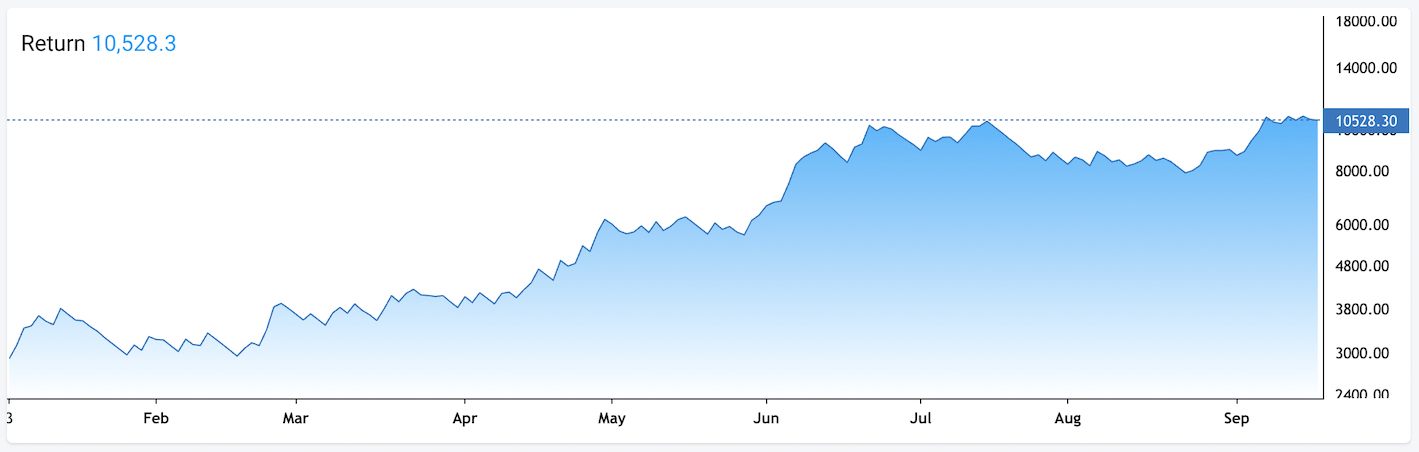

The strategy offers a speculative play which lean on high risk high reward trading approach. In such setup we review the performance over the course of last 5 years.

$3,000 at the beginning of 2022 resulted in ~$10,570 portfolio value (~252% gain) on Sep 19, 2022 with ~24.3% maximum draw down.

Prior years results are listed below

2021: 30.9% gain

2020: 8.9% gain

2019: 73.06% gain

2018: 185.75% gain

The strategy has been developed, tested and executed live with Breaking Equity Algo Lab. The post is not a financial/investment advice and presented to the audience for educational purposes.