Everyone wants a trading strategy that allows you to make one trade per day, yet you can still beat the market. Here we explore how you could make one.

The Strategy: Gap & Go for Biotech Stocks

We decided not to reinvent the wheel and just took the highly popularized “Gap & Go” strategy. The “Gap & Go” is looking for a stock gap up from the previous day’s close price with the goal to follow an uptrend. We use biotech stocks as they tend to have higher volatility compared to other industries.

An example of the ideal setup the strategy is looking for (screenshot: www.breakingequity.com)

You can easily find way more information about the idea and the thesis behind it. We also have a detailed explanation of the enter and exit conditions below.

Screening Criteria

- Biotech Equities (we’re using iShares Biotechnology ETF $IBB as a list)

- Up in the morning 3% or more

- Are above pre-market high and yesterday’s high

Enter Criteria (when to open the position)

- Stock price is above EMA 9

- Stock is going up and EMA 9 is going

Exit Criteria(when to close the position)

- Price crosses below EMA 9 and stays there for 3 bars

- End of the same day

- Trailing stop loss of 1.0%

Conditions

- $10,000 trading capital

- Do not trade early close days

- Only one trade per day

- If no equities meet the screening or entry criteria, do not trade

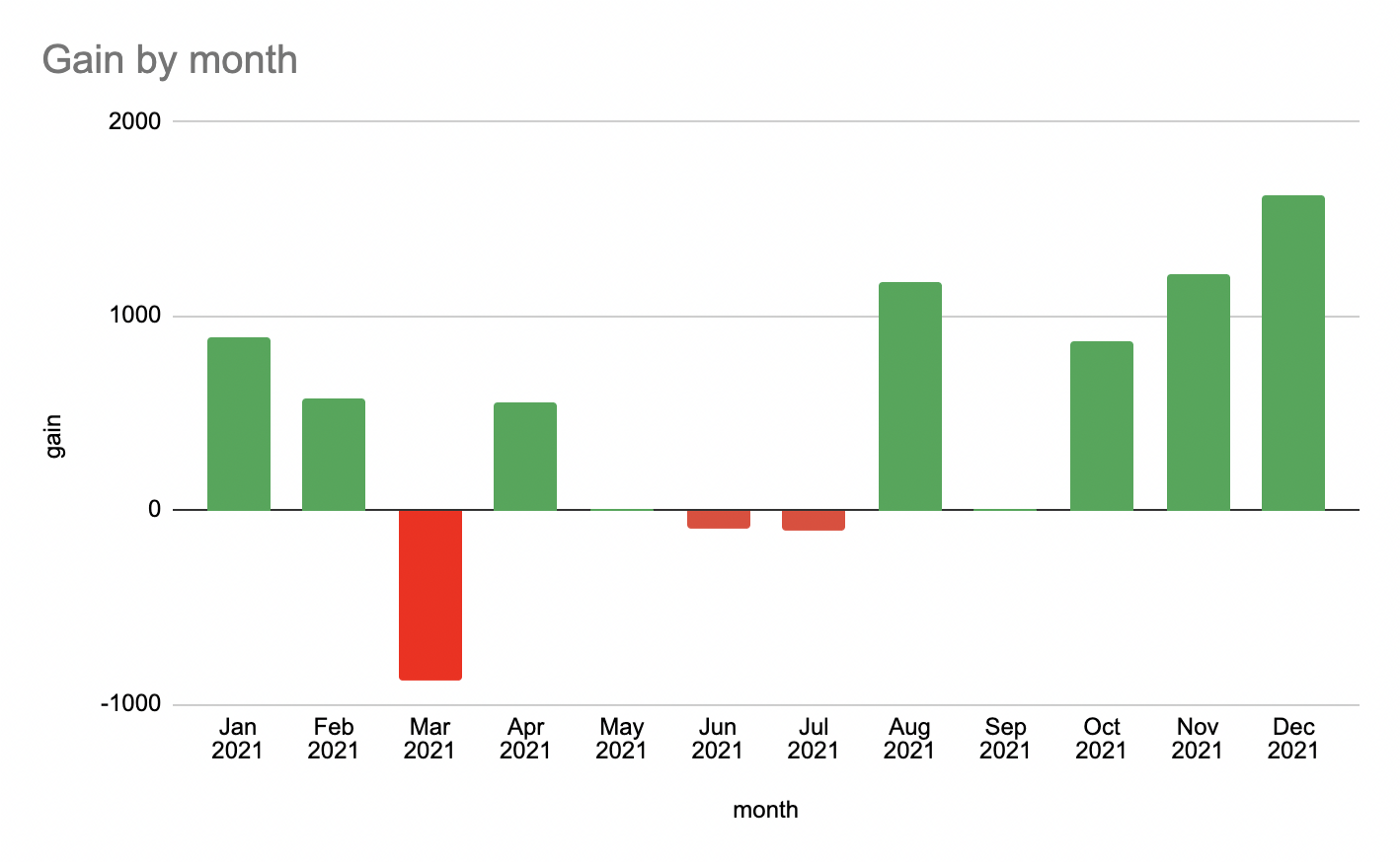

The Results: +58% gain over one year

Profit $5,801.4 | Wins 48 | Losses 49

Looks pretty decent, but we think that’s just the beginning as we’re going to improve it even further by looking at overall market conditions like $SPY behavior or news.