Although every day trader believes they can make money, many people who attempt day trading end up with a net loss. Day Trading can be a struggle. Some battle the mental aspects of trading, and some end up overcomplicating with a search for Philosopher’s Stone that turns metals into gold.

In this article we present simple trading strategies, their results and thesis behind each. Our thesis states that employing simple, yet consistent strategies can be financially rewarding.

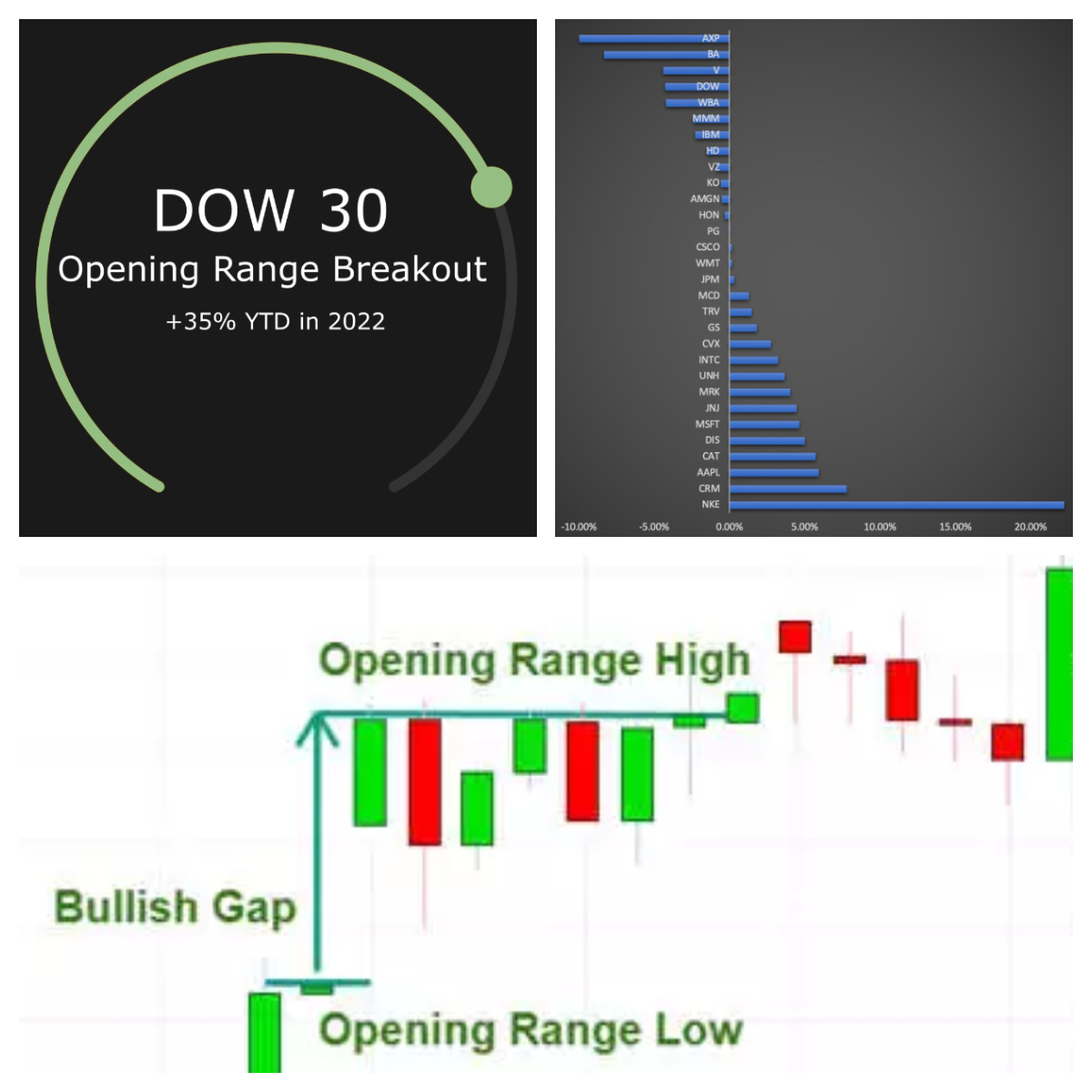

#1: DOW 30 Opening Range Breakout

Opening Range Breakout is a simple and popular trading strategy that many people use in day to day trading. The idea is that open price action often establishes the trend and the sentiment for the day. The tendency for the open to cluster near daily highs or lows gets statistical proofs on historical marker behavior.

The strategy is very simple in nature but it may be complex to get into the right stocks to trade hence we stick with Dow Jones Industrial Average index constituents. You can easily get the list from https://www.cnbc.com/dow-30/

Strategy and Results

- All DOW 30 stocks

- Filter down to those that have a gap up 1% or more from yesterday’s’ close

- Enter long position when price is above opening high on 1 min chart

- Only trade on the days when $DJIA is above yesterday’s close

Note that in the strategy we alway exit before market closes at 3:57pm and never hold overnight.

The results for the period from Jan 1, 2022 till Aug 10, 2022 were decent with 35% gain YTD outperforming the DOW30 index which scored 8% loss. Below are the gains for each stock traded.

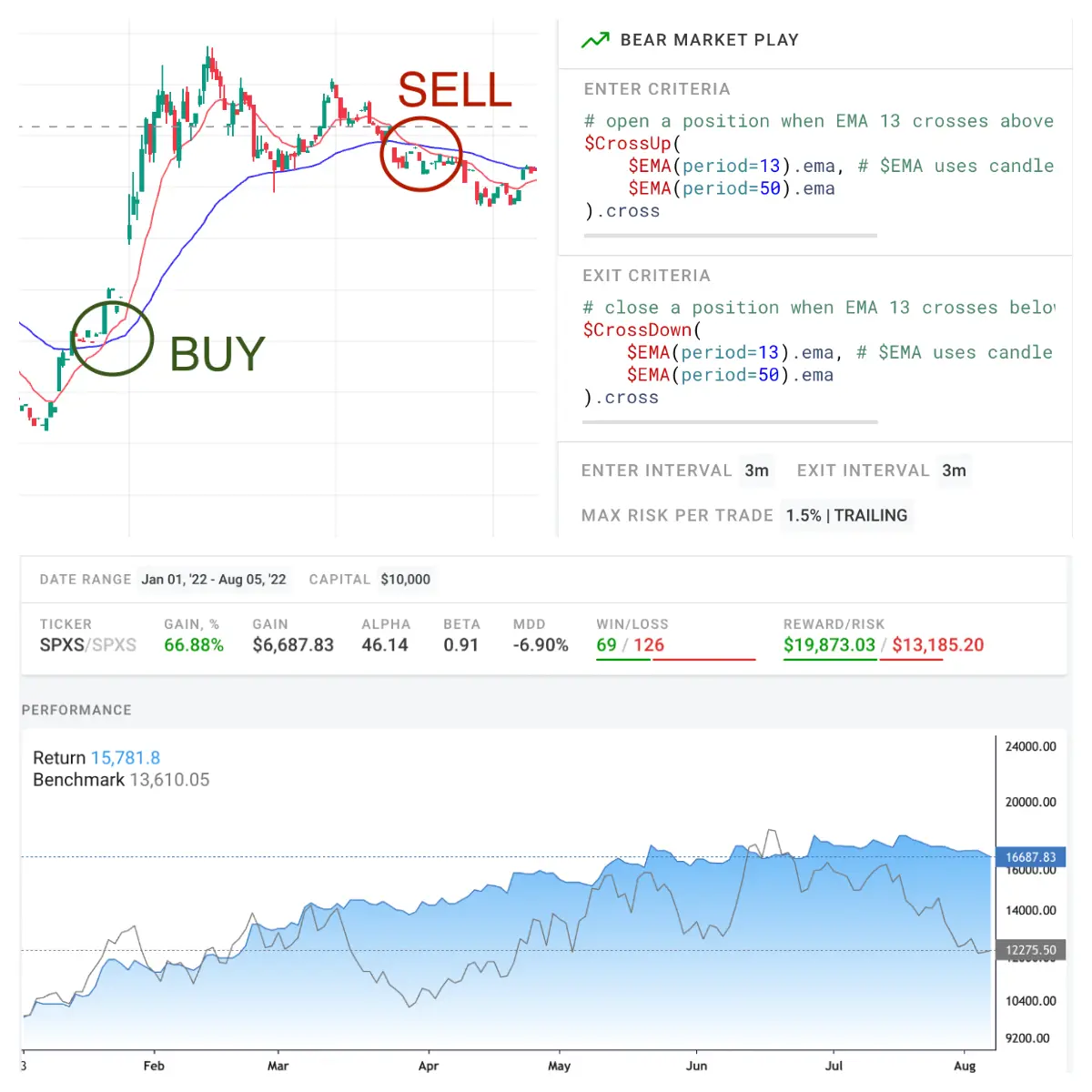

#2: 3x Leverage Bear Market Cross

Can you recognize a Bear Market? If yes there is a strategy that trades “Direxion Daily S&P 500 Bear 3X Shares ETF” $SPXS. The idea is rather simple: in bear market the stocks tend to go which makes inverse ETFs go up, -3x leverage adds to the volatility needed for day trading.

Strategy and Results

- Enters on EMA 13×50 Cross Up

- Exit on 13×50 Cross Down

- 1.5% Trailing Stop Loss

- 3min chart

Note that in the strategy we alway exit before market closes at 3:57pm and never hold overnight.

The results for the period from Jan 1, 2022 till Aug 5, 2022 outperformed $SPXS buy&hold and only had -6.9% draw down.

#3: $GME EMA Cross

$GME still gets a lot of attention. For example r/GME reddit community has 361k members with 5–10 daily posts and quite active participation. Moreover GameStop as a company does not shy away from heating up the retail interest and actively engages into market frenzy. In such environment we should be able to make money from rapid runs up and down.

Strategy and Results

The whole idea was not to overcomplicate hence we go with 10min EMA 4×8 EMA Cross and a 3% trailing stop loss. Below are a couple of images for lazy readers presenting the strategy and the results for the period from Jan 1, 2022 till Aug 10, 2022.

Note that in the strategy we alway exit before market closes at 3:57pm and never hold overnight to avoid crazy moves that can not be controlled.

All the strategies presented have been developed, tested and executed live with Breaking Equity Algo Lab platform. Breaking Equity is an automated trading platform and marketplace for retail investors to build, buy and sell Active Strategies. It’s leveling the playing field by making Active Strategies more affordable and inclusive to make sure retail traders leverage hedge fund technology and data.

Disclaimer: Before jumping the gun with any strategies perform your research and due-diligence. The post is not a financial/investment advice and presented to the audience for educational purposes.