90% of retail traders lose money. Still, day trading is able to attract millions of people in an attempt to beat the market. In this article, I will try to establish a true baseline of bare minimum performance you need to achieve in order to perform better than a coin flip.

Why a Coin Flip?

A trader eventually faces the statistic that 90% of traders fail to make money when trading the stock market. This statistic deems that over time 80%, 10% break even, and 10% make money consistently.

I trade nearly every day. Some days are great and you make money, and some days are a complete waste. I’m always trying to improve and structure the approach in the attempt to perform better and better. The other day I was talking to skeptics who mentioned: “No matter what you do in trading in the end it’s no better than a coin flip”. What a great idea, I thought… A coin flip trading bot would be a really good baseline to see how well you perform in the market.

The Setup

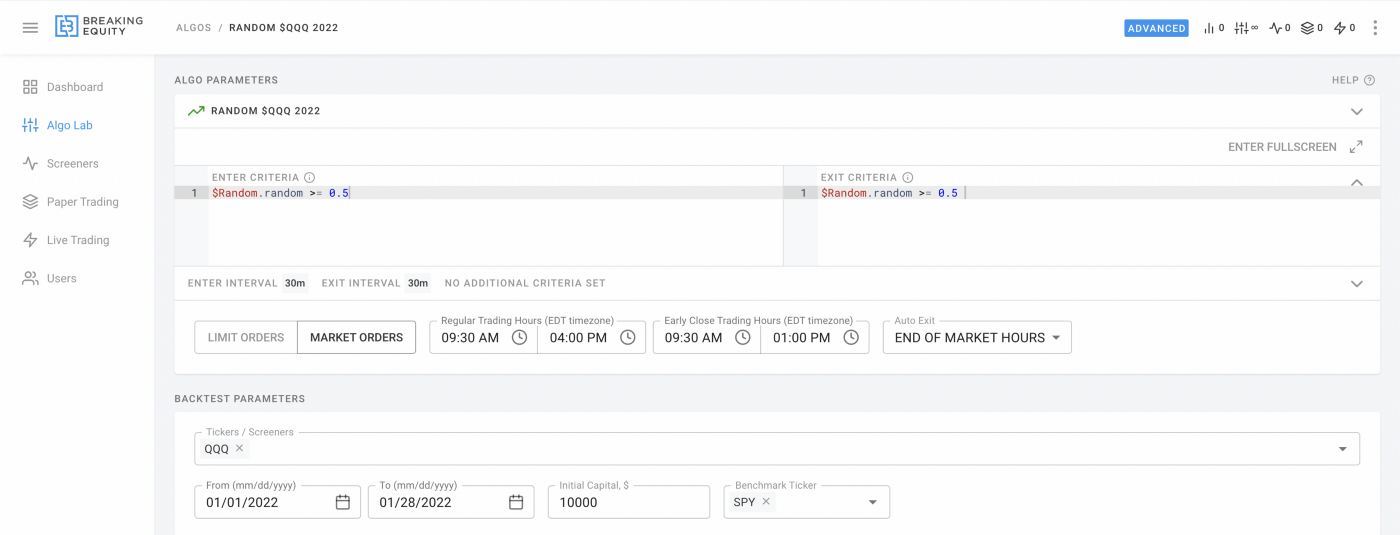

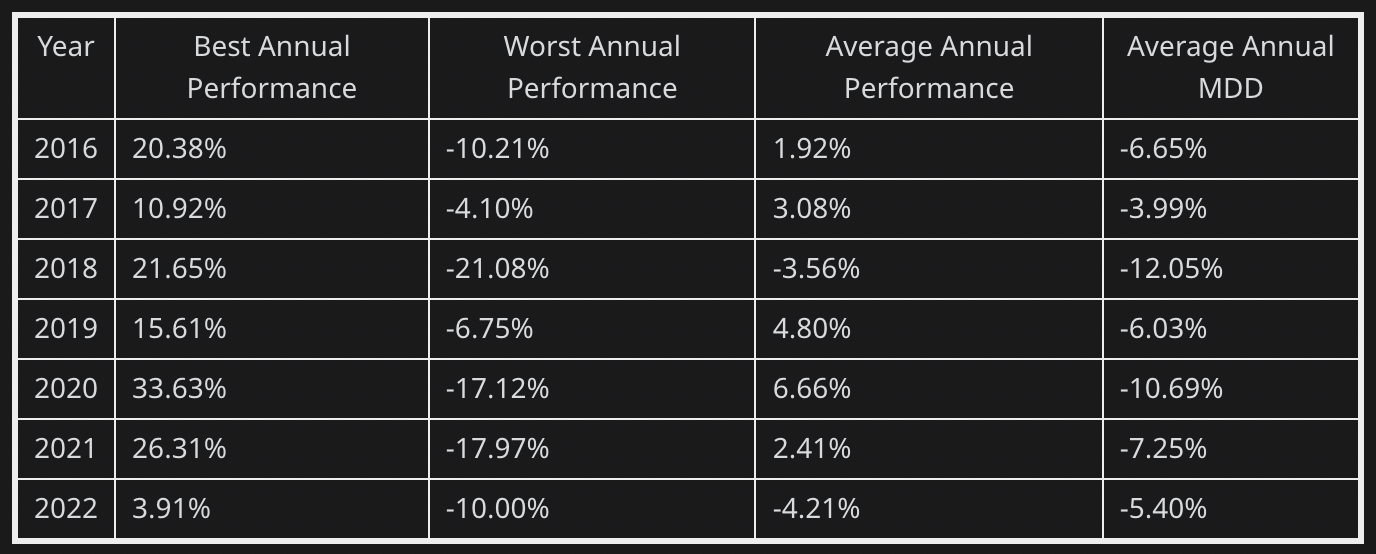

To see how a coin flip would actually perform, I wrote a coin flip trading bot and backtested the results since 2016. Since the bot cannot flip a coin, I use random(0,1)🤖

Conditions

- Trading $QQQ

- Random enter and exit on 10min intervals

- No stop loss

- Always exit EOD (no hold over night)

- Each year had 100 simulations to smooth it out

- $10,000 trading capital

The Results

Pretty good for a coin flip. At least, I expected it to perform worse than that…

If you are losing money, you’d better switch to a coin flip strategy or seriously rethink what you are doing.

PS: do not trade on a coin flip 🙂 Not investment/financial advice.