The current stock market holds more drama than your average soap opera. The sudden twists, abrupt drops, and unexpected new all-time highs could easily keep you glued to the screen, obsessively following the candles’ trajectory. It wasn’t always like this, though.

There was a time, not too long ago, where the market enjoyed calmer, gradual growth. A time where the old money exalted passive investing strategies over its active counterparts. But that has changed — in this new generation of traders, Warren Buffet’s favorite holding period – “Forever” doesn’t have as many takers. Active investors are in ascendancy.

What is Passive Investing?

Passive investing follows the mantra, “If you can’t beat them, join them.” Passive strategies don’t try to beat, time, or outperform the market with numerous buy, sell & repeat cycles. It runs on the adage that “ a portfolio is like a bar of soap. The more you handle it, the smaller it gets.” The short-term ebbs and flows of the market don’t matter. Stocks will go up in the long run.

So, how do you join instead of beating the market as a passive investor? By replicating the market performance in your portfolio with what was once derided as Jack Bogle’s folly but ultimately became the default vehicle individual investors use to play the market — publicly available Index Funds, like S&P 500, Vanguard 500, and Russell 3000.

An index funds’ goal is to mirror the market. For example, an S&P 500 index fund tracks 500 of the largest companies in the U.S. stock exchange. When you invest in an index fund, you are essentially investing in the basket of securities that makes up that index. By doing so, you get to diversify the portfolio and hedge it against the impact of an underperforming company.

Passive investing has risks that typically get glossed over in stable markets. Here is one of its biggest perils: During market turmoil, the market suffers, which ultimately gets reflected in a passive investor’s portfolio. The underperforming holdings stay locked in that index, and their positions cannot be reduced to diminish its impact.

But even with those pitfalls, the advent of index funds democratized investing by making it simple and cutting fees by over 90%.

What is Active Investing?

Active investing is all about actively buying and selling investments and continuously monitoring the market in real-time to grab profitable opportunities. It’s a heavily involved process that keeps investors checking the prices multiple times a day. This type of strategy wasn’t always popular, though. For the most part, the stock-pickers were shunned as the unruly siblings of the group who followed the buy-and-hold anthem.

Passive investing has been running the show, especially after the 2008 financial crisis when investors lost faith in active managers’ proclaimed promises to protect their portfolios in a market decline. In the coming years, the retail wasn’t spending time selecting good stocks and firing bad ones from their portfolio; instead, they were pushing money into index funds with broad baskets of stocks offered by giants like Vanguard, Blackrock, and State Street.

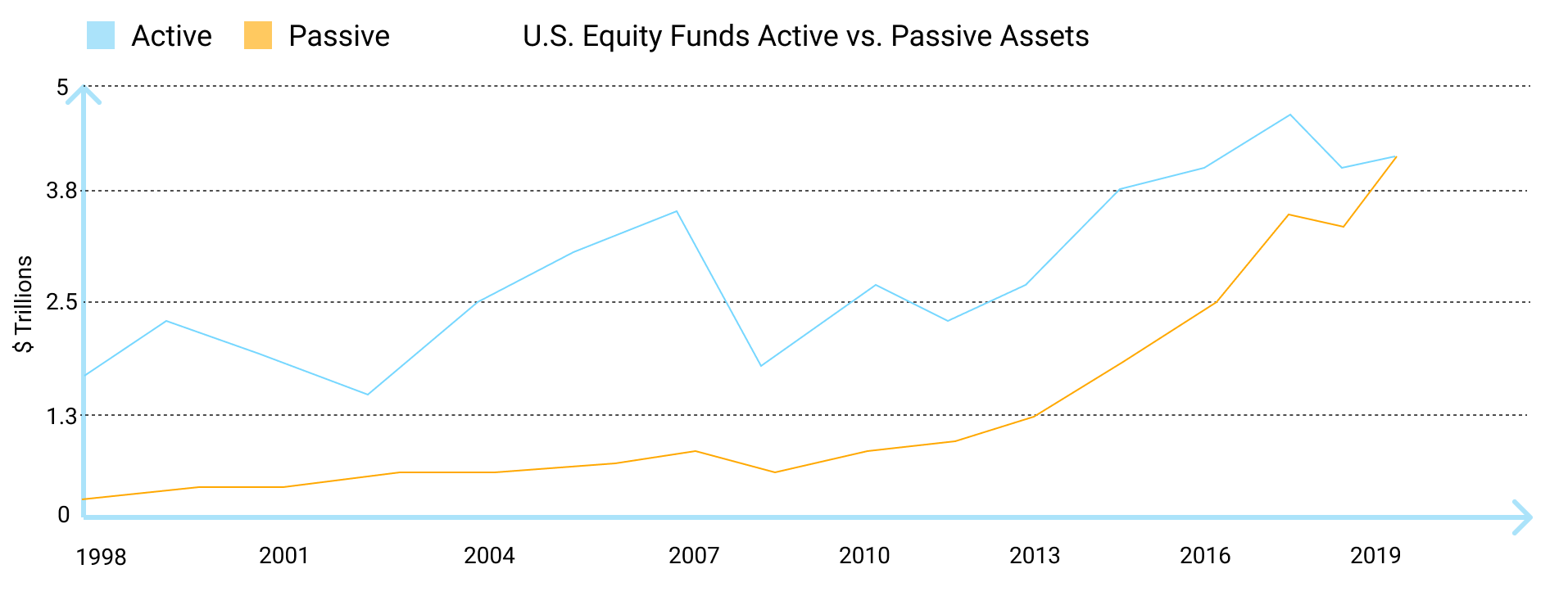

In April 2019, the amount U.S. investors held in passive assets reached $4.3 trillion, the same amount held in active assets. And by September, for the first time in history, the funds in passive assets surpassed its active counterpart.

The Resurgence of Active Investors

So the future was supposed to see index funds swelling and significantly less involvement from retail investors or hedge fund gurus reacting to the market fluctuations hour-to-hour. But surprisingly, in the last two years, the momentum has shifted yet again to active strategies. The reasons for the resurgence are many:

- The proliferation of zero-commission brokers: Once upon a time, paying $7– $10 per trade was normal. This changed at the end of 2019, when America’s major brokers like Charles Schwab, Fidelity, TD Ameritrade, and E*Trade feeling competitive pressure from Robinhood — a retail trading juggernaut — slashed commissions for online trading to zero, further making investing accessible and affordable to all. Between October 2019 to pre-lockdown, retail trading volume doubled and then doubled again once the pandemic hit and lockdown ensued.

- Seamless user experience: Stock trading apps like Robinhood surged in popularity in 2020-2021, with the user base growing from 13 million in 2020 to 18 million in 2021. Retail investors were signing up in droves, thanks to the frictionless sign-up process, no $500 minimum deposit requirement, and free stocks incentives. This stands worlds apart from how traditional brokerages did it — before, opening a trading account involved going to the bank, mailing in documents, and staying on the phone for hours. Robinhood shrunk this process to minutes and a few swipes and taps. Plus, you didn’t even need thousands of dollars to start investing. With Fractional investing, Fintech apps like Sofi enabled users to grab a tiny slice of Amazon, Google, and all other major stocks for as low as $1.

- Shrinking holding period: The Covid-19 crisis accelerated short-term investing. The uncertain future of the economy in general and company earnings has boosted the practice of speculation — trading based on information not yet available, which is one of the hallmarks of active investing. The year 2020 saw the stock market fall by up to 40 percent and rise back to the same level in three months, while the same magnitude of change in the 2008 financial crisis took three years to happen. The rapid, volatile movements, over short periods, are making the buy-and-hold principle less attractive since stocks could fly 20-30% in just a few days and then come back down — making it more attractive for active investors who can buy low, sell high to lock in profits, and buy-in low again once the stock drops. For example, in early August, MRNA rallied from $346 to nearly $500 in just eight days, then dropped back down, giving traders another chance to enter if they want.

- High-risk tolerance: Just a generation ago, investing was mainly accessible to those with generous 401(k), retirement savings, and the money to afford a broker. The rest watched from the sidelines. Now, the average investors are younger and not often wealthy. 50% of millennials and Gen Z investors state that their risk appetite increase since COVID, according to an E*Trade survey. They started investing to grow their emergency funds and find another revenue source. Armed with stimulus checks and savings, the younger investors see trading stocks as the ultimate vehicle for wealth transfer from the elites to the rest. Passive investing is seen more as a tactic for the rich to preserve their wealth.

In the stock market, there’s money to be made for all trading strategies. Active investors are fronting the show right now, making massive gains from erratic micromovements in both directions.

In recent years it’s not just brokerages that have become accessible and affordable. Robust stock analysis and automated trading tools are also available to all. Breaking Equity is empowering retail investors with next-generation trading tools that make active investing less risky and more profitable.

Create, test, and deploy algo-trading strategies to play every opportunity with maximum speed and precision. Sign up to try.